Do you also want to invest in Ethereum but need to know whether its price will rise or go down in the next five years?

With the growing popularity of cryptocurrencies, investors are looking to jump into this new asset class. But there are so many cryptocurrencies out there, and it’s difficult to predict which ones will be successful in the future.

In this article, we’ll look at Ethereum and how its price has been performing lately, as well as how investors can test future performance based on past price movements. As always, remember that past performance doesn’t guarantee future returns!

What Will the Ethereum Price be in 5 Years and 10 Years?

I am trying to answer this question as Ethereum’s price will fluctuate depending on various factors. These factors are worldwide economic conditions: the Ethereum network’s growth and people’s reactions to it.

But, if we look at Ethereum’s price history and compare it to other assets, we can get a general idea of where the price might go in the next 5-10 years. Looking at the last five years, we can see that Ethereum’s price has increased from around $10 to over $1,000.

This represents a massive price increase, and Ethereum will likely continue to increase. Ethereum may reach $5,000 or even $10,000 per coin in the next five years. And could reach $100,000 in the next ten years. But this may seem like a very bold prediction.

Ethereum Price Prediction for 2023:

Ethereum’s price will continue to go up in the upcoming years as more and more people become aware of its potential and use it. The expert predicts that by 2023, Ethereum will be worth between $1,700 and $8,000[1] per coin.

This is based on many factors, including the increasing use of smart contracts—the growing number of decentralized applications built on Ethereum and the rising number of institutional investors buying Ethereum.

Ethereum Price Prediction for 2024:

In 2024, Ethereum’s prices are expected to be approximately $3,674.80 and $4,336.04 based on technical analysis by cryptocurrency experts. The average estimated trading costs will be $3,803.17.

Ethereum Price Prediction for 2025:

According to Coinpedia, In 2025, the price of Ethereum is expected to reach $5,700 to $10,000. This prediction assumes that Ethereum will become the dominant platform for smart contracts and Decentralized Applications (dApps). Suppose Ethereum’s transition to proof-of-stake is successful. While this is a bold prediction, it is not out of the realm of possibility.

If Ethereum can continue to grow at its current pace, there is no reason to believe it will not reach $10,000 by 2025. The Ethereum network is already the most popular platform for dApps, and it is only getting stronger. With the rise of Defi and NFTs, Ethereum is well-positioned to continue its growth.

Ethereum Price Prediction 2030:

In total, Finder panelists predict that ETH will be worth more than $14,000 by 2030, but another forecast is less optimistic. Digital Capital Management managing director Ben Ritchie believes ETH may reach $15,000 in 2030. It is due to upcoming upgrades, including lower gas fees and scalability.

According to him, Ethereum’s price is very closely attached to the success of the upgrade, and it may outperform bitcoin in the medium to long run.

Ethereum Price Prediction Highs and Lows

The Ethereum price has been turbulent over the past few years. Reaching highs of over $4,635 in November 2021 before plunging to lows of around $993 in June 2022. The good news is that the price recovered to $1,981 in August 2022 and is currently trading at about $1,110.

However, it’s impossible to predict where the price will go. It could continue to rise and reach new highs or fall back to its previous lows. The only sure thing is that the cost of Ethereum is volatile and unpredictable.

Are Past Ethereum Predictions Accurate?

It is difficult to say for sure. Many predictions about Ethereum have been based on speculation and opinion rather than concrete evidence. It is essential to treat all Ethereum price predictions as speculation. Always do your research (DYOR) before making any decisions.

To make a better prediction, consider looking at past price movements and evaluating what could happen in the future based on similar events. A few people predicted the price of Ethereum in the past.

One is Joe McCann, Angel Investor and Crypto Margin Trading. Here is an interview [2] with him. He predicted that Ethereum would reach $50,000 by March 2022, which we witnessed never happen in March 2022.

Another is Anthony Sassano, Founder of The Daily Gwei, Ethereum Developer, and Supporter. Here is a fantastic interview[3] with him. He predicted that Ethereum would reach $150,000 in 2023, which is unrealistic.

Andrew Keys, A co-founder of ConsenSys Enterprise and director of communications at ConsenSys, predicted Ethereum would reach $1.15 on February 29, 2016. As expected, his prediction came true, and the asset soared to over $1,400 two weeks into 2016. Here are his insights on ETH 2.0 and rolled-out phases. [4]

How to Read Ethereum Charts and Predict Price Movements?

To get serious about trading Ethereum, you must understand how to read Ethereum charts. By understanding the basics of charting, you’ll be able to predict future price movements.

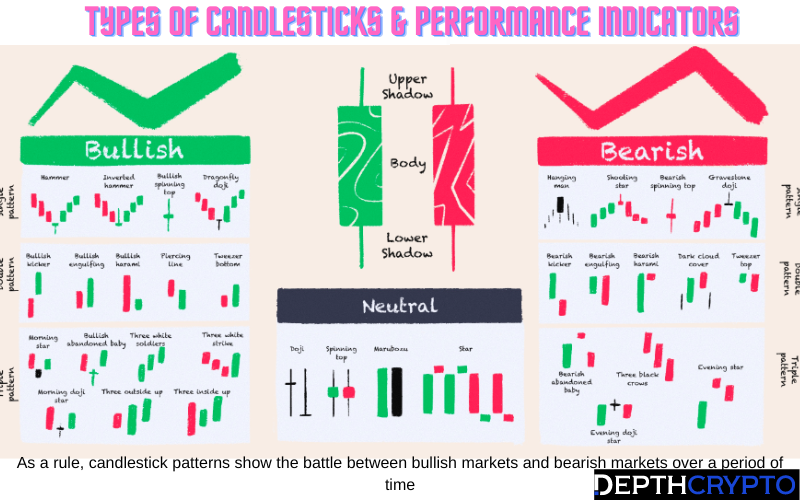

Before you start analyzing individual candlesticks and trying to predict short-term movements, take a step forward and look at the big picture. What is the overall trend? Is the price of crypto going up, down, or sideways?

Once you know the overall trend, you can look for specific support and resistance levels. These are areas where the price tends to reverse course. The most important thing to understand about charts is that they show you historical data. Collecting this data makes it possible to find patterns in it.

Once you identify a trend, you can predict where the price will likely go. To trade Ethereum, you can use a variety of charts. Candlestick charts are constructive in this regard. Candlestick charts show each period’s open, close, high, and low prices. They also offer you the direction of the price movement.

Line charts are another popular type of chart. Line charts show you the closing price for each period. They don’t show you the direction of the price movement, but they can help identify support and resistance levels.

Bullish price prediction patterns[5] are typically used to signal that prices will likely continue increasing in value in the future. An ascending triangle pattern is one of the bullish price prediction patterns most commonly used. This pattern is created when the price of an asset forms a series of higher lows and lower highs.

An ascending triangle pattern is one of the most commonly followed bullish candlestick patterns. The ascending triangle pattern is formed by a downtrend line (A) and a series of uptrend lines (B).

The ascending triangle pattern is typically considered bullish. It is because it signals that the price will continue to rise despite any pullbacks or corrections.

Bearish price prediction patterns, on the other hand, signal that prices will continue to move lower in the future. A descending triangle pattern is one of the most commonly used bearish price[6] prediction patterns.

This pattern is created when the price of an asset forms a series of lower highs and lower lows. The descending triangle pattern is typically bearish because it signals that the price continues to move lower despite any bounces or corrections.

A general rule of thumb is that if you see a bullish price prediction pattern (like an ascending triangle), you expect prices to continue to rise and do not want to sell. However, if you see a bearish price prediction pattern (like a descending triangle), you expect prices to continue moving lower and will want to sell your asset.

What Influences Ethereum’s Price?

When it comes to cryptocurrency prices, there is no such thing as a sure thing. However, certain factors can influence the cost of Ethereum (ETH). Here are a few most important ones:

1. Media Hype

In a way, the media is responsible for controlling the price of Ethereum. If there’s a lot of positive media coverage, it can drive up the price. On the other hand, if there’s negative media coverage, it can drive the price down.

2. Regulation

Regulation is another important factor that can influence the price of Ethereum. If a country or region announces that it’s cracking down on cryptocurrency, it can cause the price of ETH to drop. Conversely, if a country or region reports that it’s welcoming cryptocurrency with open arms, it can cause the price of ETH to rise.

3. Economic Conditions[7] (Macro Financial)

The state of the economy can also influence the price of Ethereum. It’s been shown that when the stock market falls, so does Ethereum. When it rises, Ethereum usually follows suit. As you can see, these are just some of the things that can have an impact on Ethereum and its price movements in the future.

Of course, any of these variables may not affect Ethereum, depending on what happens with them in coming years – which makes predicting its future price movements even more difficult!

Ethereum Overview

When Was Ethereum Created?

Ethereum was created in 2015 by Vitalik Buterin[8], a Russian-Canadian programmer. Buterin had previously co-founded Bitcoin Magazine and was involved in the Bitcoin community before proposing Ethereum as a more general-purpose blockchain platform.

Ethereum’s launch was funded by a crowd sale in which participants bought Ether, the native cryptocurrency of the platform. On July 30, the Ethereum blockchain became operational.

Ethereum 2.0[9]

Known as Eth2, or Ethereum 2.0, this upgrade to Ethereum intends to increase the number of transactions processed on the Ethereum network.

As a result, Eth1 is now the execution layer, where smart contracts and network rules reside. In contrast, Eth2 is the consensus layer, where devices contribute to the network according to its laws.

What Gives Ethereum Value?

Ethereum’s value comes from the fact that it has been created as a platform for people to build things on top of it. There are many use cases for Ethereum as well. The first factor is utility.

Ethereum can be applied to various industries and fields, including finance, law, healthcare, and even voting systems. As more companies adopt the technology and start using it to solve real-world problems, Ethereum will become an increasingly valuable commodity with a higher price tag.

Ethereum Market Cap

The current Ethereum Market Cap is $40.12 Billion on November 09, 2022.

Ethereum Technical and Fundamental Analysis

Ethereum has been one of the best-performing assets of 2020, showing no signs of slowing down.

The second largest crypto by market cap is currently trading at $1,138 since the start of the year.

Ethereum’s impressive rally has been driven by several factors, including increasing institutional interest, the launch of ETH 2.0, and Defi mania. Looking ahead, Ethereum is poised for more gains in the months ahead as the Defi sector continues to grow and attract more users.

How Will The Merge Change Ethereum’s Operation?

The Merge is a proposal to make Ethereum work in two chains[10] after the upgrade, one with no newly added updates and the other where upgrades are installed. The first chain would be the leading Ethereum network. While the second would be a sidechain used for all competent contract execution.

The sidechain would be connected to the main chain through a two-way peg, which means that any ETH or ERC-20 tokens on the main chain could be moved to the sidechain and vice versa.

The main selling point of The Merge is that it would allow Ethereum to scale much more efficiently than it currently can. This is because all smart contract execution would take place off-chain on the sidechain, freeing up the main chain to process transactions much faster.

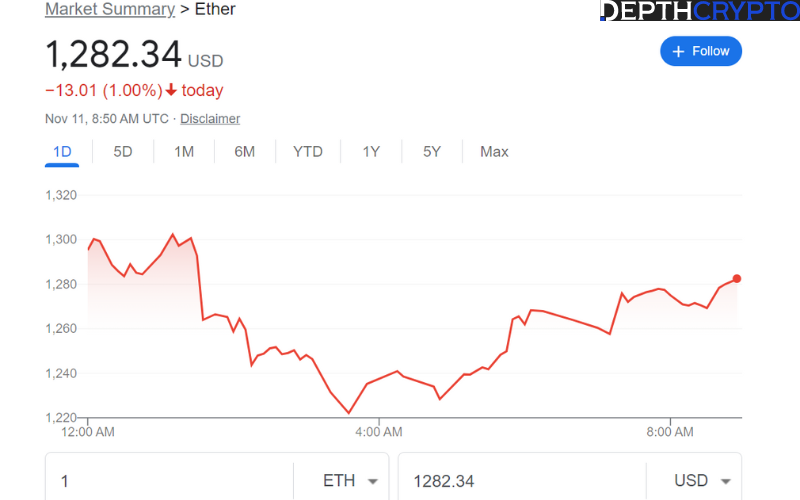

How Much is 1 Ethereum right now?

The price of the Ethereum is $1,140 on Binance and $1,133 on Coindesk with a -14.39% 24 hours low. If you want to buy Ethereum, you need to read this guide.

Ethereum Price History

The Price History of Ethereum is fascinating. Ethereum started at $0.3015 on Sep 14st, 2015, and hit a high of $4,724 on November 11, 2021. Ethereum’s price has been one of the more volatile assets this year, with rapid changes in value even by cryptocurrency standards.

From highs over $3,713 down to lows above $1,051 on June 22, 2022. However, since then, it has shown signs of recovery as it sits at around $1,936 as of August 14, 2022. It is predicted that the Ethereum Price will be higher in five years, and in ten years, it will be over the thousands of dollars.

Conclusion

Ethereum price prediction is difficult to predict. This is primarily due to Ethereum’s rapid growth. Ethereum mining difficulty will likely continue increasing, and this could lead to a decrease in price.

Additionally, if Ethereum transactions become too expensive, many users may leave the network and choose other cryptocurrencies as their primary mode of transaction. Finally, many other new cryptocurrencies are being introduced every day.

These new competitors pose a threat to Ethereum, and it’s possible that they could overtake it in terms of value and market cap. The Ethereum price saw an enormous jump in 2017 and has been trending upward.

If you are looking for a long-term investment (click here to buy), Ethereum may be a good choice. However, if you are looking for short-term investments, Ethereum may not be better due to its high volatility and significant price fluctuations.

FAQs

Can you buy Ethereum for $1?

Unfortunately, due to its higher fee schedule, you cannot buy a portion of Ethereum for $1. You can buy as little as $25 on Coinbase. That being said, if you’re already trading on exchanges, you may purchase a fraction of Ethereum depending on its price at that exchange.

How to Protect Your Ethereum Investments?

If you are an Ethereum investor, one of the most important things to do is to protect your investment. One way to do this is using hardware wallets such as Ledger Nano S and Trezor. Hardware wallets store your private keys offline, so your funds will be safe even if your computer is hacked. Another method that can help protect your investment is to use a two-step verification process.

How to Buy Ethereum?

Buying Ethereum can be done through a variety of exchanges. Coinbase is one popular option to buy Ethereum with your debit card, credit card, and bank account. If you want an extensive guide on buying Ethereum, check out our comprehensive guide here.

Is Ethereum a good investment?

The price of Ethereum has been subject to a lot of volatility, but it is predicted that Ethereum will continue to grow. The cryptocurrency market is volatile, and prices can go up and down. If you are thinking about investing in Ethereum, it might be a good idea to invest a small portion of your portfolio.

Is ETH better than Bitcoin?

Bitcoin and Ethereum are two of the most popular cryptocurrencies on earth. Bitcoin is better known than Ethereum, and it’s usually easier to buy and trade. But Ethereum has much more potential than Bitcoin, mainly because it’s built to handle more transactions. In our opinion, ETH is better than BTC as long as you don’t need to make small transactions quickly.

[2] White Crypto. (2022, January 6). Joe McCann is bullish on Solana! Crypto bull run ended? Interview with Angel investor, the trader. YouTube. https://www.youtube.com/watch?v=wzy9vaiVTt8

[3] Bankless Shows. (2021, September 14). Manic about Ethereum | Anthony Sassano. YouTube. https://www.youtube.com/watch?v=UxZXqfdzWto

[4] FINTECH TV. (2020, December 7). ETH2.0 with Andrew Keys | DARMA Capital. YouTube. https://www.youtube.com/watch?v=gQK48ZVRjN8

[5] Wikipedia contributors. (2022g, November 10). Candlestick chart. Wikipedia. https://en.wikipedia.org/wiki/Candlestick_chart

[6] User, S. (n.d.). Chart Patterns & Probabilities. https://tradingcenter.org/index.php/learn/chart-patterns

[7] Yhlas, S. (2018a). Factors Influencing Cryptocurrency Prices: Evidence from Bitcoin, Ethereum, Dash, Litcoin, and Monero Munich Personal RePEc Archive. Mpra.Ub.Uni. https://mpra.ub.uni-muenchen.de/85036/

[8] Wikipedia contributors. (2022h, November 11). Ethereum. Wikipedia. https://en.wikipedia.org/wiki/Ethereum

[9] What’s Ethereum 2.0? A Complete Guide. (2022b, October 25). Worldcoin. https://worldcoin.org/articles/whats-ethereum-2-0

[10] Wikipedia contributors. (2022i, November 11). Ethereum. Wikipedia. https://en.wikipedia.org/w/index.php?title=Ethereum