If you have heard of any crypto exchange platform, it is probably eToro.

Crypto early adopters have been trading coins on eToro since 2007. Still, the platform gained mainstream attention in 2010 when it released its OpenBook social investing platform and the Copy Trader feature.

Today, over 25 million users [1] are trading over $500 billion worth of cryptocurrency on eToro each quarter.

To help you learn more about this crypto exchange platform, understand its pros and cons, and see it compares to other crypto exchange platforms, keep reading our eToro Review 2022.

Our opinion

eToro [2] is a great option for investors interested in low-cost trading of cryptos, CFDs, stocks, and forex on an awesome mobile app or web.

It provides free ETF and stock trading, one of the best crypto selections in the industry, and an easy account opening.

The platform’s biggest appeal is the copy trading feature. It allows users to track the portfolios and trades of other experienced investors. Besides, it has an easy-to-use and intuitive trading platform. This makes it ideal for beginners.

However, there are some areas on eToro that could be better. For instance, it has high non-trading fees, elusive customer support, and inflexible account plans.

EToro Pros & Cons

Pros:

- Seamless account opening

- Free ETF and stock trading

- Social and copy trading

- Comprehensive educational materials and resources

- Advanced crypto trading tools and features in mobile app

- Free debit card deposits

- Easy and intuitive user interface

- Demo account

Cons:

- Customer support needs improvement

- High non-trading fees

- Limited cryptocurrencies selection

- Not available in every US state (Nevada, Minnesota, Hawaii, and New York)

- No cryptocurrency-to-cryptocurrency trading pairs

Company Overview

eToro was launched in 2007 in Israel by entrepreneurs from the world of technology and finance who wanted to make the world of forex trading accessible to everyone.

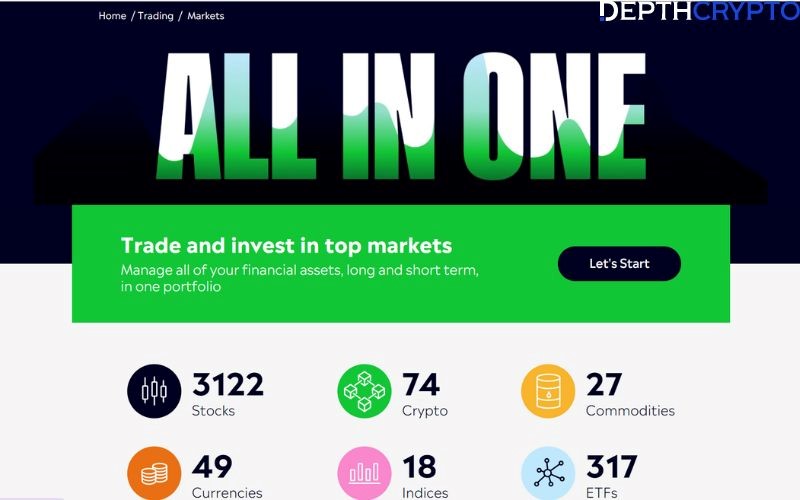

Although the company focused on forex initially, it has expanded its product lineup and services over the years. For instance, it includes ETFs, stock trading, cash management features, crypto, and automated portfolios.

Its flagship offering is the community or social investing feature known as Copy Trader.

eToro boasts more than 25 million active users and operates in over 140 countries.

eToro

With over ten years of experience in the technology and finance industry, eToro has placed itself as the most popular and one of the leading social investment networks and trading platforms.

It is a regulated service that offers a wealth of assets, including cryptocurrencies, ETFs (Exchange-Traded Funds), stocks, and forex.

eToroX

On 26th April 2019, eToro announced the launch of a fully regulated crypto exchange platform called eToroX.

Unlike the original eToro platform, eToroX gives investors direct access to crypto-assets instead of requiring transfer rules and additional withdrawal steps.

Invest in Stocks

If you invest in stocks without leverage, you are investing the real asset, not CFD. Typically, this feature is not provided by other forex and CFD brokers.

eToro has a stock market of 17, which is lower than other stockbrokers like Interactive Brokers (80) or Saxo Bank (35).

However, traders can only invest in the more popular stocks. If you invest in more popular stocks like Apple or Microsoft, you will probably not notice the absence of smaller stocks.

So, eToro will often make new stocks available for investing, normally in a batch.

Invest in Crypto Assets

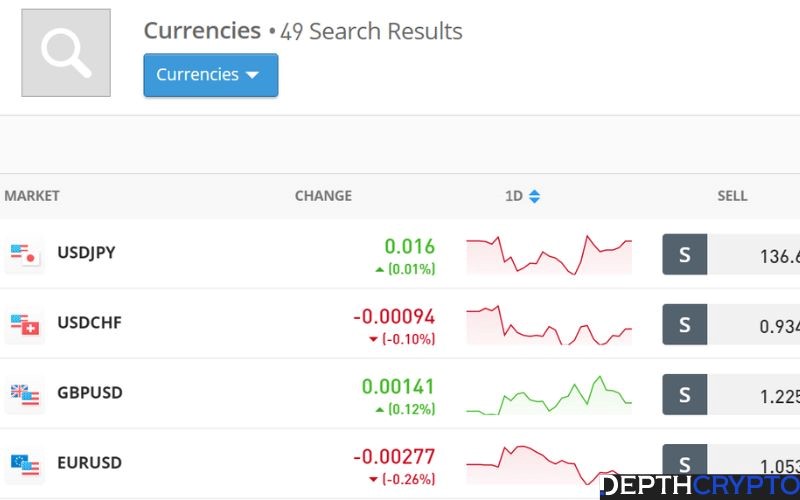

eToro allows users to trade 14 cryptocurrency crosses (like BTC and ETH) and about 63 non-US dollar currency crosses (like AUD/LTC).

It provides the following to own, invest in, and trade cryptocurrencies

- Crypto CFDs

- Spot crypto

- Crypto exchange (eToroX)

- Crypto wallet.

However, not all these methods are available in every state or country. For instance, UK investors cannot access the Crypto CFDs method.

According to eToro, crypto prices fluctuate widely. So investing in crypto-assets is not appropriate for all traders.

Besides, Cryptoassets are unregulated in the UK and highly volatile. Therefore, when you invest in crypto-assets using eToro, you will not be eligible for consumer or investor protection.

Available Cryptocurrencies

30 cryptocurrencies are available in the US, and about 80 coins are supported internationally.

Along with STORJ, LRC, BAL, and GALA, traders on eToro can access BTC, DOGE, ETH, UNI, BCH, MIOTA LINK, LTC, XTZ, XRP, BNB, DASH, ETC, ZEC, ADA, TRON, NEO, XLM, and EOS.

eToro Fees

Trading and Transaction Fees

eToro charges users a fee of 1% for selling or buying crypto assets on its platforms.

For ETF and stock trades, eToro does not offer commission. For instance, the broker foots the cost for regulatory transaction fees when investors sell a stock or ETF.

eToro Trading Fees

eToro charges a fee of 1% on crypto trading transactions plus a spread. This is relatively lower than the fee charged by some of its competitors.

However, if you are an abuy-and-hold investor looking to trade crypto (buy and leave it for a long time), you should be aware that eToro charges a fee for inactive accounts that have been dormant for one year.

CFD Fees

The CFD fees of eToro are generally low.

eToro CFDs fees are charged through spreads. For instance, CFD cryptos are charged at a rate of 0.75%, and CFD stock starts at 0.09%

The table below shows an eToro benchmark CFD fee for a $2,000, 5:1 long trading position held for one week.

| eToro | Trading 212 | XTB | |

| S&P 500 index CFD fee | $3.1 | $1.4 | $4.0 |

| Europe 50 index CFD fee | $3.2 | $2.0 | $3.3 |

| Apple CFD fee | $6.4 | $16.5 | $10.1 |

| Vodafone CFD fee | _ | $14.7 | $10.6 |

Forex Fees

The forex fees of eToro are generally low and are seen as the average in the market.

Generally, you can expect eToro fees that vary significantly according to the trader’s currency of choice.

The table below shows an eToro benchmark forex fee of $20,000, a 30:1 long trading position held for one week.

| eToro | Trading 212 | XTB | |

| EURUSD benchmark fee | $15.6 | $26.7 | $17.7 |

| GBPUSD benchmark fee | $4.5 | $21.8 | $12.2 |

| AUDUSD benchmark fee | $9.6 | $16.7 | $12.1 |

| EURCHF benchmark fee | $12.5 | $16.9 | $6.1 |

| EURGBP benchmark fee | $16.4 | $25.6 | $12.6 |

Non-Trading Fees

eToro offers high non-trading fees. For instance, it charges a fee of $10 monthly after a year of inactivity. However, logging into your eToro account counts as an activity.

| eToro | Trading 212 | XTB | |

| Account fee | No | No | No |

| Inactivity fee | Yes | No | Yes |

| Deposit fee | $0 | $0 | $0 |

| Withdrawal fee | $5 | $0 | $0 |

The non-trading withdrawal fee at eToro is $5.

eToro Features

eToro offers a wide range of features for both beginner and experienced (professional) investors. Keep reading to learn more about some of its features.

Stocks and ETFs

eToro provides an array of assets for users looking to plunge into online investing.

Stocks

With over 5,000 different companies from 17 primary stock exchanges worldwide, eToro offers something for every online trader.

eToro’s market offerings and stock allow you to invest in various companies, from travel, telecommunication, and banking to retail, healthcare, finance, and technology.

eToro also allows investors to trade stock CFDs.

EFTs

eToro offers online investors a wealth of ETFs (Exchange Traded Funds) to trade. Many investors resort to EFTs as it lets them gain exposure to various asset classes and markets.

This increases diversification compared to investing in mutual funds or picking individual stocks.

eToro features some of the world’s most popular ETFs like;

- SPDR S&P 500 ETF (SPY)

- Vanguard Total Stock Market ETF (VTI)

Besides, as of December 2022, eToro gave users access to 265 ETFs.

Deposit Fees and Options

eToro supports a wide range of deposit options. Some of the available deposit options include:

- Paypal

- Bank transfer

- Skrill

- Credit/debit card

- China UnionPay

- Neteller

However, not all of these deposit options are supported in every country. Besides, eToro only allows you to deposit funds from banking sources in your name.

Although eToro does not charge any deposit fees, there are currency conversion rates. For example, you might be charged as high as 1.40% for depositing EUR by credit/debit card.

Withdrawal Fees and Options

eToro charges a withdrawal fee of $5. This is higher than other CFD brokers. Besides, it has a minimum withdrawal limit of $30.

The withdrawal options supported by eToro are the same as the deposit options. For instance, you can withdraw funds from your eToro account via the;

- Bank transfer

- Credit/debit card

- Electronic wallets

Storage and Security

eToro offers a free digital wallet known as eToro wallet. This allows users to store their cryptocurrencies and is available on Android and iOS.

You will be charged a 2% fee to transfer funds from your eToro’s investment app to its crypto storage wallet.

Cash assets are stored in FDIC (Federal Deposit Insurance Corp.) insured bank accounts for up to $250,000.

The security protocol for cryptocurrencies includes online and offline storage of coins, state-of-the-art monitoring tools, and two-factor authentication.

eToro staff members can not transfer your cryptocurrencies out of storage.

Mobile Apps

Users can access their eToro account and all the trading tools via mobile application. For instance, eToro has a user-friendly and intuitive mobile trading app for iOS and Android devices.

The eToro mobile apps allow you to check prices, monitor your portfolio, and place trades. They also give you access to various features like;

- Chart tools for tracking markets in real-time

- Watch lists of individual stocks

- News updates

- Push notifications for important events.

However, activating two-factor authentication for the eToro mobile apps is vital.

Usability

eToro has a simple design, which makes it easy for users to find whatever they are searching for. The web and app platforms offer similar features and features. This allows traders to trade via their preferred platform seamlessly.

The Copy Trading feature allows users to quickly search for and copy the crypto trading strategies of popular investors. It also necessitates the sharing of trading knowledge and insights.

The News features also add another interactive element of usability to the eToro platform. For instance, you can share trading news and decisions via social media platforms like Twitter and Facebook.

Although these features combine to make interactive, unique trading usability and experience, eToro’s inability to short positions disadvantages Famous Investor program trading strategies.

Moreover, Copy Trading is only available to trade crypto – stock and ETF trading are not supported in this feature.

Customer Service

Generally, eToro customer support is below average. Their primary support channel is via a web-based ticketing system, which usually takes a long time to get a response.

The support is available in all 21 languages supported by the eToro mobile and web trading platforms.

We received feedback from users that eToro responds to basic questions within 48 hours. On the other hand, complex questions or issues can take up to 14 days to get a response.

Live Chat is only available for eToro Club members, and you can only initiate the Live Chat session after logging into your eToro account.

Customer Satisfaction

As of December 2022, eToro had recorded over 25 million users. This should give a good indication of its popularity.

On Trustpilot, over 15,000 users have awarded eToro an average rating of 4.2 out of 5.0 stars, with about 54% of reviewers rating the platform as excellent.

The eToro App users also liked it. For instance, on Google Store, eToro received a rating of 4.0 stars out of 5.0; on the Apple Store, their rating is 4.2.

However, there are also negative reviews. Most of them revolved around unresponsive customer support and difficulties making withdrawals.

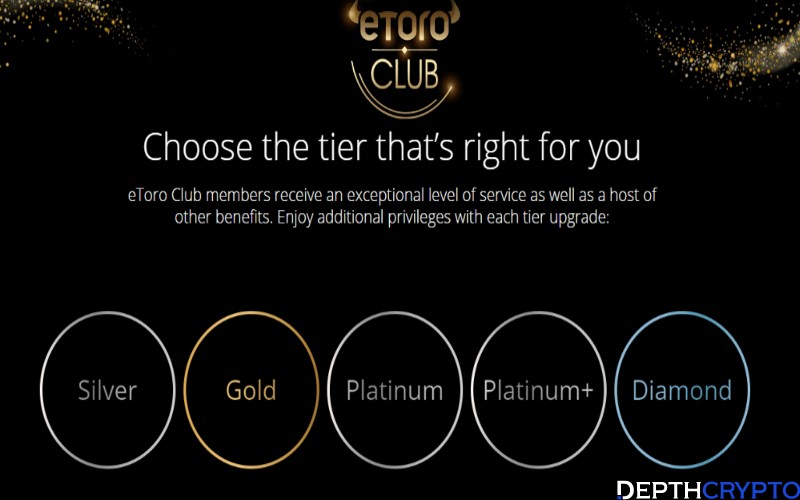

eToro Club

eToro Club members get access to various tools and services designed to understand and experience the capital markets.

These include investment opportunities in;

- Crypto

- Stocks

- Smart Portfolios

eToro club also provides a wealth of educational resources and opportunities to assist members in making knowledgeable investment decisions and growing their portfolios.

Whenever you join the eToro Trading platform, you are given access to the eToro Club. Your trading platform assets will determine the eToro Club level.

The starting level for all eToro users is the Bronze level. To get access to other levels, you must have the following equity:

- Silver level: $5,000

- Gold level: $10,000

- Platinum level: $25,000

- Platinum Plus level: $50,000

- Diamond level: $250,000

Education

eToro education section is available to all retail investor accounts. It includes the following sections:

eToro Academy

The eToro Academy is a platform that teaches eToro users how to navigate the eToro trading platform easily. It provides educational resources for both beginners and experienced traders.

It also offers comprehensive tutorials on topics like;

- Technical analysis

- Trading strategies and fundamentals

- Market psychology and more

eToro Academy also includes on-demand video courses, written guides, and live webinars from eToro professionals.

The Bull Club

The eToro Bull Club gives users a chance to talk to experts. This education section also has a library of old webinars.

The eToro Plus

The eToro Plus education section gives users access to monthly, weekly, and daily analysis articles written by various eToro experts.

Smart Portfolios

The eToro’s Smart Portfolios (initially called CopyPortfolio) are curated asset collections that you can invest in.

You can use them to diversify your online investment easily. They also provide an automatic means of investing for users who need more knowledge and time due to their research.

Free Debit Card Deposits

Unlike many other crypto exchange platforms that charge a fee for debit card deposits, making debit card deposits is free on eToro.

You can make fee-free deposits of traditional currencies like US dollars (fiat money), debit cards, or bank transfers. However, you will be charged a conversion fee for non-US dollar transactions.

Tools and Calculators

eToro lacks many research tools, trading amenities and functionality, and powerful calculators that many complex investors would find essential in conducting advanced trading techniques.

The goal, financial, screening, and planning tools are also largely nonexistent.

This prevents users from executing many types of investing strategies.

Charting

eToro gives users access to charting capabilities via ProCharts (a professional-grade technical tool).

This charting feature assists users in analyzing their asset’s performance and history by providing candle, bar, and line charts.

eToro also allows users to view two or more charts on one screen. This lets you compare their performance easily.

However, one major drawback is that eToro’s charting feature doesn’t offer volume analysis, which is a primary component of technical market analysis.

Trading Idea Generators

Copy Trading gives you access to the extent of Trading Idea Generators at eToro.

For instance, you can search, copy, and follow investors’ trades that match your goals and interests.

This feature is, however, only available for cryptocurrencies.

News

The News feature of the eToro platform gives you access to a wide range of insights and weekly site journals that offer content, such as Crypto Roundup, appealing to different interests.

You can unlock more news features on eToro by investing more money.

For instance, Silver-level users are offered access to live-stream webinars. Gold-level users add a subscription to Business Insider and Delta Pro, while Platnum-level users get access to the Wall Street Journal.

On the other hand, Diamond level members and Platinum Plus level users can access a Financial Times subscription.

Third-Party Research

The third-party research feature on eToro is powered by TipRank.

This is a top source for up-to-date recommendations from experienced and professional analysts at financial companies and investment banks worldwide.

Cash Management

eToro offers solutions to all your cash management needs – thanks to the eToro Money feature.

This feature allows users to:

- Easily send and receive money

- Deposit and withdraw funds

- Store cryptocurrencies

SRI/ESG Research Amenities

ESG (Environment, Social, and Governance) scores are provided for over 2,000 assets on the eToro platform.

This information is usually visible, as users will view different color patterns. They will also see a rating based on how well their asset aligns with socially conscious values.

eToro also allows you to screen for SRI (Socially Responsible Investing) factors with a filter while searching for assets.

Range of Offerings

eToro gives users access to various offerings on international versions of their experience. However, the US eToro has very limited offerings than its competitors.

For instance, there are no forex, futures contracts, mutual funds, or options trading. Besides, all trading is limited to long positions only.

So, on eToro, users can access;

- 24 cryptocurrencies

- 22 ETFs

- 2,075 stocks

- Portfolio automation provided via Smart Portfolios

- Cash management via eToro Money

- Fractional share investing provided for amounts above $10

Order Types

eToro platform has a narrow range of order types. For instance, Basic Order Types include;

- Market

- Trailing stop loss

- Limit and other similar options

It supports more complex Order Types such as OTO (order-triggers-other), which helps traders too;

- Take gains off the table

- Quickly enter and exit positions

- Navigate risk,

However, these sophisticated order types are not supported by eToro.

Fractional Dividend Reinvestment Plan (DRIP)

eToro has fractional dividends paid out on its platform. However, they can not be automatically reinvested in the trader’s portfolio.

eToro will only credit a payment to the trader’s cash balance if they hold a position in ETF or stock that pays dividends.

Portfolio Analysis

eToro gives users limited portfolio analysis, especially about competitor platforms.

Although you can see current positions and balances clearly, there is little information for further analysis other than the charting features.

For instance, eToro has adequate charting capabilities. However, it only gives users a sense of performance instead of assisting them in seeing where portfolio changes might be required.

Transparency

Generally, the eToro platform has a transparent platform when it comes to pricing. However, it lacks in terms of executing statistics.

For instance, cryptocurrency pricing is laid out explicitly at 1% for all trades. It also does not charge any fee for ETF and stock trading. However, some ETFs can have additional expenses.

Besides, the PFOF (Payment For Order Flow) and spread pricing information is available.

However, the inability of traders to transfer funds back to their eToro platform from the storage wallet might take time to become obvious to new users.

Trading Experience

eToro has an easy-to-use and innovative social trading experience that allows users quickly leverage expertise from other traders.

You can evaluate investors based on performance metrics and user ratings. This helps ensure that you follow a trading (investing) strategy that aligns with your interests and goals.

Social & Copy Trading

Instead of only doing regular stock traders, eToro allows users to invest in the portfolio of others. For instance, Copy trading is an innovative eToro feature that lets you replicate or copy the trading strategies of successful and experienced investors.

With Copy Trading, you can select from a pool of experienced professional traders and replicate their trades automatically.

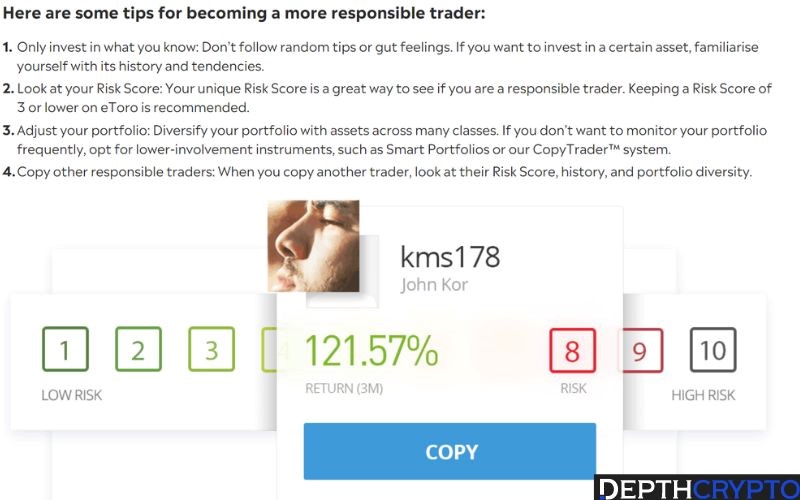

However, it is vital to check the risk score of a particular trader before you replicate trades from users in the popular investment program.

The minimum Copy Trading investment is $200.

Account Base Currencies

eToro only allows US dollar accounts. For instance, money in other currencies must be converted by eToro to US dollars.

This means that users will be charged more fees to convert their money. However, you can save on currency conversion fees by opening a multi-currency bank account.

Besides, according to eToro, users can use their Revolut account to make deposits and withdrawals in EUR, GBP, and USD.

Web Trading Platform

eToro’s trading platform, popularly known as WebTrader, is a powerful, user-friendly, and secure way to manage all your eToro investing and trading activities.

It gives users access to various eToro services and features in real time.

Its intuitive user interface makes it easy to navigate. This allows users to easily access all the information required to execute trades efficiently and quickly.

It also includes a wide range of customizable options tailored to your needs.

Moreover, it features various analytical tools to assist users in making informed decisions. Such tools include;

- Market research tools

- Risk management tools

- Portfolio management tools

- Charting tools

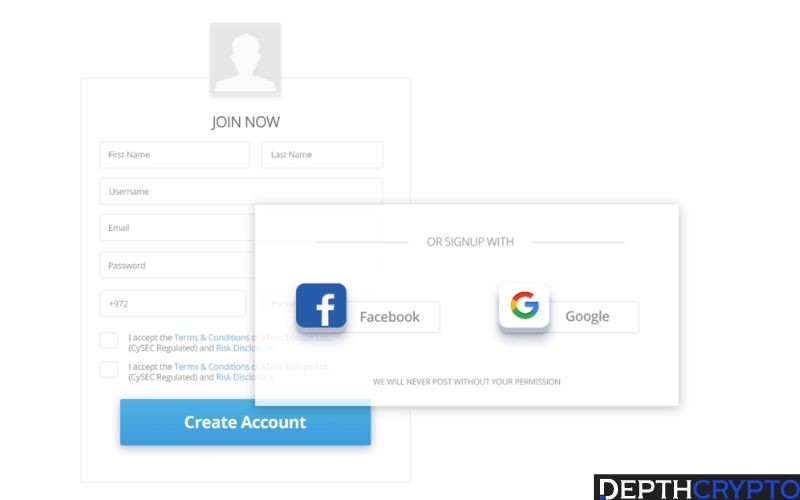

How to Open an Account with eToro

The procedure for opening an account with eToro is straightforward and quick.

Follow this guide to open your account with eToro:

Step 1: Register your account with eToro using your email or social media accounts like Facebook or Google.

Step 2: Go through identity verification. This is especially vital if you want to add funds to your account or trade. So, you need to upload government-issued documents for proof of residence and proof of identity.

Step 3: Convert your funds into USD, as eToro only supports USD accounts. There are many depositing options you can use, such as

- Credit/debit card

- Bank transfer

- PayPal

- Skrill

- Neteller, and more.

You can use the same deposit option to make withdrawals from your account.

What eToro Can Do to Improve

More Coin Options

The lack of altcoins, especially in the US, is a big issue for eToro.

Although eToro supports some major crypto coins, other coins, such as SOL (Solana), are unavailable in the US lineup.

Therefore, improving eToro’s coin offerings in the US will greatly increase the platform’s usability and value.

Better Customer Service

eToro investors can only contact customer support via Live Chat or help ticket. The support is generally poor as the response time is long.

Therefore customer support should be improved to be more responsive and available 24/7. It should also offer support via email and phone.

Alternatives To Consider

If you want a wider selection of cryptocurrencies, Coinbase is a top crypto exchange platform worthy of considering. However, it may not offer trading in stocks or other investments. It has a great platform for advanced traders and supports hundreds of cryptocurrencies.

If you are looking to trade cryptocurrencies and stocks in one place, Robinhood is the perfect eToro alternative. It charges no transaction fee and supports 10+ cryptocurrencies.

eToro vs. Coinbase

| eToro | Coinbase | |

| Crypto Coins | Over 50 cryptocurrencies | Over 50 cryptocurrencies |

| Wallet Storage | Stores coins on the user’s eToro trading platform account. You can also transfer to your wallet or move to the eToro wallet | Stores coins on the Coinbase Wallet option or Coinbase account. You can also transfer to your wallet |

| Fees | Varies by crypto: 0.75%-4.9% spread | 0.50% spread and the trading fee range from 1.49% to 3.99% (or $0.99 to $2.99 flat fee) |

| Minimum Trade | $25 (you deposit a minimum of $50) | $2 |

Final Thoughts

eToro is one of the leading brokers for real CFD and stocks you can use. It will allow you to invest crypto assets from the US stock exchange market and other markets like Asia, Europe, the UK, etc.

You can also use its Copy Trading feature to replicate successful eToro traders. However, you should check and review their success rate before starting to invest.

We hope this eToro review has answered everything you need to know about eToro. Now open your eToro account and start investing your crypto. However, remember to trade with money you are comfortable losing.

eToro FAQs

How does eToro make money?

eToro doesn’t make its financial statements public. However, eToro’s main source of revenue is thought to be the following:

- Overnight fee: For the cost of financing users’ CFD (Contract For Difference) positions between days. So they are charged an interest (fee) for using leverage.

- Spreads: This is the gap between the price that users and brokers buy/sell at.

- Other non-trading fees: These are fees that are not directly related to eToro trading.

Who regulates eToro?

eToro is regulated by top financial authorities in the UK, Australia, and Cyprus. For instance, it operates the following legal entities:

- eToro (UK) Limited: This is regulated by the United Kingdom financial authority called Financial Conduct Authority (FCA).

- eToro (Europe) Limited – Cyprus: This is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license # 109/10 for servicing European Economic Area (EEA) member states.

- eToro (AUS) Capital Pty Limited: This is regulated by the Australian watchdog, known as the Australian Securities & Investments Commission (ASIC).

Can I use eToro in the USA?

Currently, users in the United States of America (USA) can not use all features and services offered by eToro. This is because US regulations do not allow trading in CFD (Contract For Difference) instruments for US residents. And eToro is a CFD broker.

Therefore, no regulated broker in the US will allow retail clients to trade CFDs. However, US clients can trade real stocks, ETFs, and crypto on eToro.

Is eToro trustworthy?

Generally, eToro is a trustworthy trading platform for cryptocurrency users. For instance, it complies with trading and crypto regulations in the country it operates. Besides, all the users’ funds are securely stored in FDIC-insured bank accounts – up to $250,000.

However, if there is a hack, it is unclear if your assets held in eTuro are insured, either with eToro’s savings or a third-party policy.

Is eToro good for beginners?

eToro is a good and safe choice for beginners. For instance, it has a user-friendly and intuitive interface that beginners can use to trade and learn about cryptocurrencies.

However, even with eToro, crypto remains a highly speculative and volatile investment. So, only invest or trade with what you are comfortable losing.

[2]. Wikipedia contributors. (2022, November 20). eToro. https://en.m.wikipedia.org/wiki/EToro

[3]. Just a moment. . . (n.d.-c). https://www.etoro.com/discover/markets/cryptocurrencies/coins